After a 5-year hiatus, Network 10’s Shark Tank has returned to screens across Australia for its 5th edition, which ran from 28 August to 17 October 2023. Across 8 episodes, 35 brave entrepreneurs pitched their businesses for investment to a fresh panel of Sharks. Of these, 22 secured investment from one or more Sharks and 13 left with empty pockets.

Moore Australia's Corporate Finance team has analysed this season’s pitches and reveals the investment themes, dealbreakers, red flags and key learnings for Australia’s entrepreneurs.

The Blind Date

The panel of self-made millionaire Sharks haven’t earned their place in the tank without some frugality in the way they deploy their “hard earned” capital. Throughout the season, entrepreneurs asked for as little as $25 thousand to as much as $1 million of investment to grow their business. But no matter how big or small the ask, a clear, substantiated and attractive Use of Funds was a pre-requisite to make a Shark dip into their pockets.

Many entrepreneurs entered the tank without a clearly defined use of funds with financial projections to back it up. Others scared Sharks off with unattractive budgets that don’t align with the business’ growth path. The following are some of the key takeaways from the Sharks’ feedback:

- Growth Capital: Investors generally prefer to see their funds promptly utilised to fuel the next growth phase of the business. Successful entrepreneurs had entered the tank with a clear plan and evidence of how the funds would propel growth. For example, a founder looking for investment to grow an e-commerce platform would need a digital marketing plan and a proven high return on ad spend to reel in a Shark.

- Bottomless Pit of Product Development Investors might be hesitant to fork out cash for development of an unfinished product, expansion of a product line, or developing SKUs. The probability of a return on investment is unclear without market testing. Successful founders had a complete product and a sound go-to-market strategy.

- Capital Intensity: Investors may shy away from businesses that require substantial capital to scale, such as those seeking funds to open a manufacturing facility. A compelling pitch should clarify how the funds will be used to immediately improve revenue growth.

- Land Grab: With the age of ultra-low interest rates seemingly behind us, investors in public and private markets have started emphasising the importance of profitability. The sentiment was evident in the tank, where Sharks were cautious about investing in companies expected to need substantial capital to reach profitability and were unwilling to fund a cash burn for a land grab.

Market doesn't lie

Venture capitalists and angel investors often query founders, “What problem is your product solving?”. It epitomises what makes innovative businesses successful – if you can solve a problem for your customer, the demand for your product will follow.

The Sharks exuded this mantra throughout Season 5, placing an emphasis on the importance of a clear product-market fit, backed by market testing for demand. Without some form of Market Validation, Sharks placed a heavy discount on valuations or opted out of investing altogether.

For business who could demonstrate demand through revenue growth or at least pre-orders, Sharks were more willing to invest and less likely to discount the valuation proposed by the entrepreneur.

Part of market validation also involves clearly quantifying a market or industry size, defining your niche of the market and validating how your product fills a void for those customers. A common red flag for the Sharks was entrepreneurs not knowing if their customer will be retail or wholesale, having too many stock-keeping unit (SKUs), not having any pre-orders or at a minimum completed market testing.

Risky business

With any business transaction you can expect some negotiation on price and Shark Tank is no exception. In Season 5, we saw some of the most ‘sharky’ discounts placed on entrepreneur’s valuations by the millionaire predators, with an average discount of 55%. The Sharks cited several reasons for the reduced valuations:

- Blood, sweat and tears: For businesses that require significant hands-on mentorship and involvement from a Shark, a larger portion of the equity pie was demanded.

- Natural predator: Even the mighty Great White is wary of its natural predator, the Killer Whale. Not being the first to market, or the threat of a larger industry player copying a product, leaves Sharks to discount the value of an investment to factor in risk of competitors. Founders should know the size of the industry they operate in, concentration levels, entry barriers, industry trends, risk factors and major players.

- Know your numbers: Sharks were frustrated with founders who didn’t know their business’ financial performance or projections. Common questions which entrepreneurs should be able to answer quickly include what the business’ historical turnover is, profit, cash flow to shareholders, gross margins, and 3-year budgeted revenue and profit figures.

- Valuation methodology: The Sharks were equally bemused by some of the aggressive valuations the entrepreneur’s proposed without any evidence to back up their assessment. Pegging your business’ valuations to other companies in the same industry is common practice and allows your valuation to capture industry specific risks and expected market demand for your business.

Sharks place a hefty discount on record valuations

.png)

Average asking amounts have fallen to $240 thousand compared to $363 thousand in the 4th season back in 2018. Entrepreneurs’ valuations on the other hand have increased to nearly $3 million from $2.3 million. The average asking valuation was significantly higher than any other season of Shark Tank. This includes three $10+ million valuations and a monster $15 million valuation for Catchy, a food catching accessory for highchairs and toddlers already achieving $8 million in annual revenue. The median asking valuation was more aligned with previous years at $1.5 million.

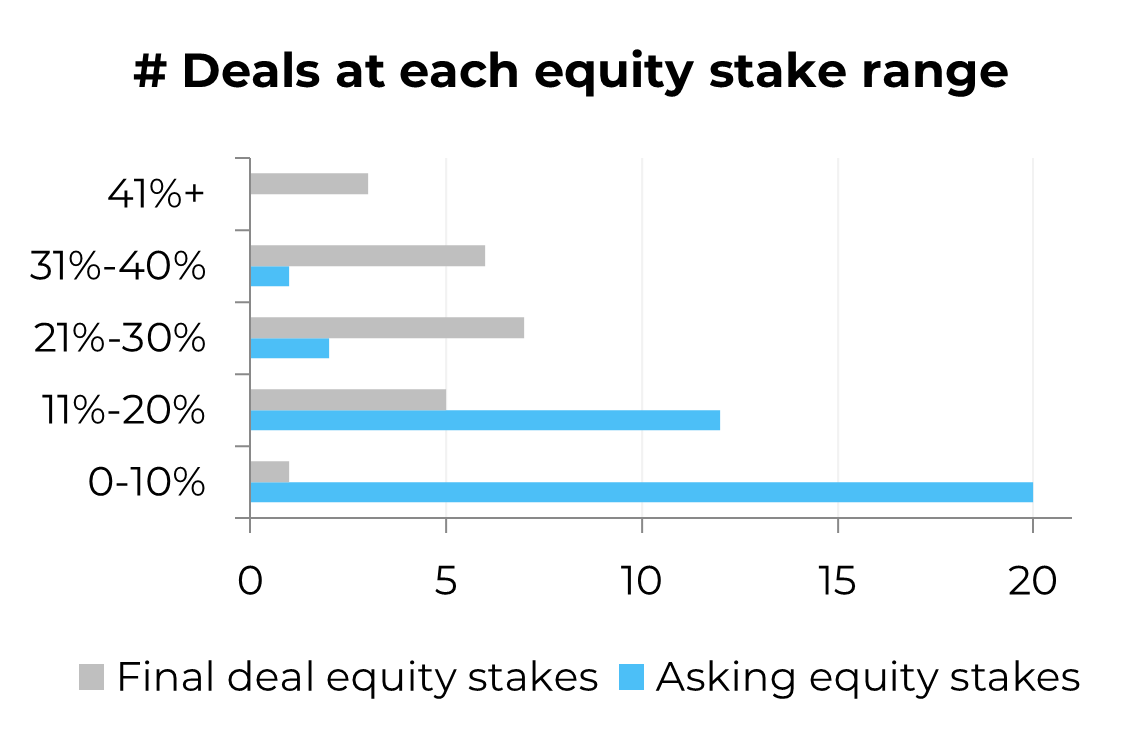

In typical fashion, the Sharks were not buying this season’s inflated valuations. They discounted by 55% on average, bringing the average final valuation of successful deals to $1 million, in line with previous seasons. The average investment amount was $213 thousand at an average equity stake of 32%, which was significantly higher than the average asking equity stake of 14%, showing how Sharks typically demand a bigger slice of the pie than offered.

Investment by Shark

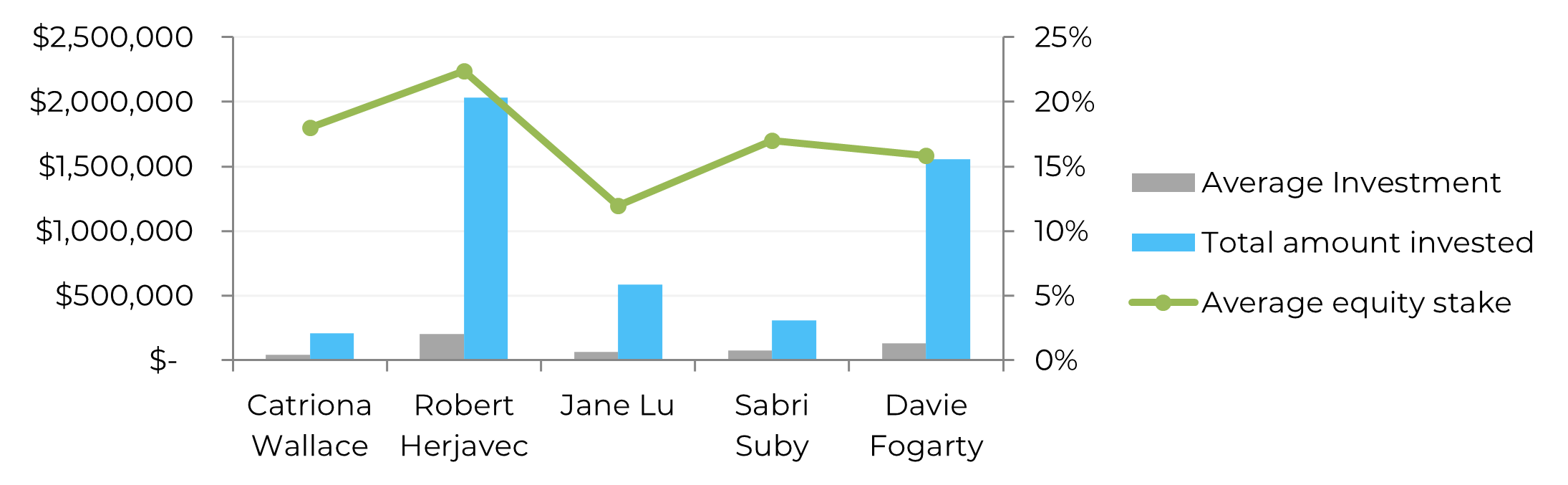

Robert Herjavec, the $300 million net-worth founder of The Herjavec Group, a security solutions integrator, reseller and managed services provider, was the biggest fish in the pond this season. The Canadian invested over $2 million across 10 deals for an average equity stake of 22%.

AFR Young Rich Lister Davie Fogarty inked 12 deals for an average equity stake of 16%. The South-Australia founder of The Oodie invested $1.6 million in total. Fellow Aussie Jane Lu who founded e-commerce fashion business Showpo also invested $584 thousand across 9 deals.

High stakes

As expected, there was a large disparity between the Entrepreneurs’ asking equity stakes and the Sharks counter offers. Founders mostly sought to give away between 0% and 20% of their businesses, but the Sharks preferred to take a 20% to 40% stake in return for their capital, mentorship and business expertise.

Don't get bitten!

We hope you have enjoyed this article as a bit of fun.

But if you are thinking about selling your business, raising capital, or would just like to know what it’s worth, the Moore Australia Corporate Finance team can help with:

- Formal business valuations and pricing papers.

- 3-way financial modelling to support business strategy and valuation ask.

- Sale readiness reviews.

- Capital and debt fundraising, including Information Memo’s.

- Merger & Acquisition / investor market research.

- Assistance with deal negotiation and completion.