The Bill introducing the superannuation guarantee (SG) amnesty received Royal Assent on 6 March 2020 and employers have until 7 September 2020 to correct any historic non-compliance with their SG obligations.

The Amnesty was first announced in May 2018 and following the reintroduction of the previously lapsed Bill in September 2019, we finally have some closure in relation to the Amnesty as we were in limbo for a long period of time waiting on Parliament to pass this legislation.

The Changes

The following changes have been introduced as part of the Amnesty:

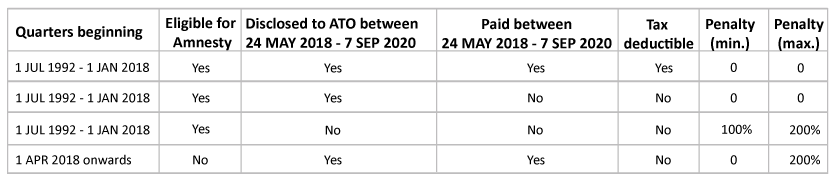

- Allowing a tax deduction for late payments – employers are generally denied a tax deduction where they have paid SG late. As part of the Amnesty, employers will be able to claim a tax deduction for any late superannuation payments provided they relate to quarters beginning from 1 March 1992 to 1 January 2018. The Amnesty is not available to quarters beginning 1 April 2018 onwards.

- It is important to note that for any payment to be tax deductible, the amount must be paid by 7 September 2020 and the disclosures must be made in an approved form.

- Removal of administrative penalty - the $20 administrative penalty that applies to each employee for every quarter will be removed.

- Reducing Part 7 penalties - Part 7 penalties which can be issued by the Australian Taxation Office (ATO) up to 200% of the underpaid SG will be reduced to nil during the Amnesty period.

- Reducing the ATO’s powers to remit penalties after the Amnesty period ends: The ATO’s powers to reduce the Part 7 penalties after the amnesty period ends will be affected and the ATO will not be able to reduce the penalty below 100% once the amnesty period ends for quarters beginning 1 July 1992 - 1 January 2018. The purpose of introducing this change was to encourage employers to use the Amnesty as any non-compliance which is discovered later will be penalised heavily.

The above can be summarised in the following table:

Increased ATO audit activity

Over the last few years, we have noticed significant ATO audit activity around SG obligations. With the introduction of single touch payroll and Superstream, the ATO receive “live” information making it a lot easier for them carry out audits promptly.

From an employer’s point of view, the concern of any SG audit is that the ATO is not restricted to the amendment periods which exist for income tax, GST and FBT. Therefore, provided records exist, the ATO can technically go as far back to the introduction of SG i.e. 1 July 1992.

The Amnesty provides a great opportunity to get your “house in order” and allows you to claim a tax deduction as well, which will not be allowed once again after the amnesty period ends.

Items that may need to be disclosed

An underpayment of SG may be caused by a variety of factors and some common factors we see in practice include:

- Making late payments – SG is payable by the 28th day following the end of a quarter and the payment must be received in the employee’s superannuation fund by that date. Where payments have not been made by this date, the employer is required to lodge an SG charge form with the ATO and pay them the underpaid SG amount (unless the amount has been paid to the employee’s superannuation fund and is offset against the liability) along with any interest accrued which is calculated at 10% and accrues until the form is lodged, regardless of any earlier (but still late) payment.

It is important to note that even if you have paid the amounts to the employees’ superannuation fund after the due date, you would still need to complete and lodge the SG charge forms with the ATO within two months of the quarter end. If these are not done, the ATO may issue you with a Part 7 penalty at a minimum of 100% once the Amnesty period ends for quarters beginning 1 July 1992 - 1 January 2018 which means you may have to pay the SG twice if non-compliance is discovered at a later date!

- Incorrect calculation of SG – SG is payable on ordinary times earnings (OTE) and many employers rely on their accounting systems to calculate OTE. Whilst most accounting systems may be correct, it is extremely important to continuously check your systems to ensure they comply with the ATO’s views on OTE contained in SGR 2009/2.

- Employee vs contractor issues - There have been some recent cases around the old question of whether a person is an employee or independent contractor and it is important to ensure you have considered this in detail if you have hired individuals under a contract or are paying individuals principally for their labour.

In practice, we see reliance on some common misconceptions around hiring contractors (e.g. “If they have an ABN, no superannuation is payable”) and employers being penalised significantly during an ATO review as a result of this due to a lack of understanding and documentation to support their position.

Making disclosures

If you would like to make use of the Amnesty or further information in relation to this, feel free contact us and we will guide you through the process.

Our services would generally include (but will not be limited to):

- Reviewing your historical payroll data and ensuring payments have been made on a timely basis;

- Checking your payroll system to ensure OTE is being calculated correct;

- Reviewing contractor agreements and ascertaining whether any SG risks exists;

- Preparing the necessary disclosures to the ATO and dealing with them through the process; and

- Ascertaining and dealing with other obligations which may be affected (e.g. payroll tax).