The Australian Taxation Office (ATO) released draft Practical Compliance Guideline (PCG) 2022/D5 which sets out their compliance approach for businesses that engage workers and classify them as employees or contractors. In 2022, the High Court handed down two decisions that impact how businesses distinguish between employment and contractor relationships.

Historically, businesses needed to consider a range of factors in making the distinction which included (but were not limited to) level of control, powers of delegation, liability for risk and basis for payment. Following the decisions handed down in the High Court, it is now the legal rights and obligations in the contract alone that are relevant in determining whether the worker is an employee of an engaging entity. Draft Taxation Ruling (TR) 2022/D3 which was also released at the same time as PCG 2022/D5 further explains the 'label' which parties choose to describe their relationship, whether within a written contract or otherwise, is not determinative of, or even relevant to, that characterisation. Furthermore, 'labels' used to describe the relationship which are inconsistent with those rights and duties have no meaning.

Therefore, the terms of a contract are relevant in making this distinction and not the label used to describe a relationship i.e. if you hire someone as an independent contractor but the terms of the contract reflect that it is an employment relationship, the ATO will take the view that the individual is an employee as opposed to an independent contractor.

RISK ASSESSMENT FRAMEWORK

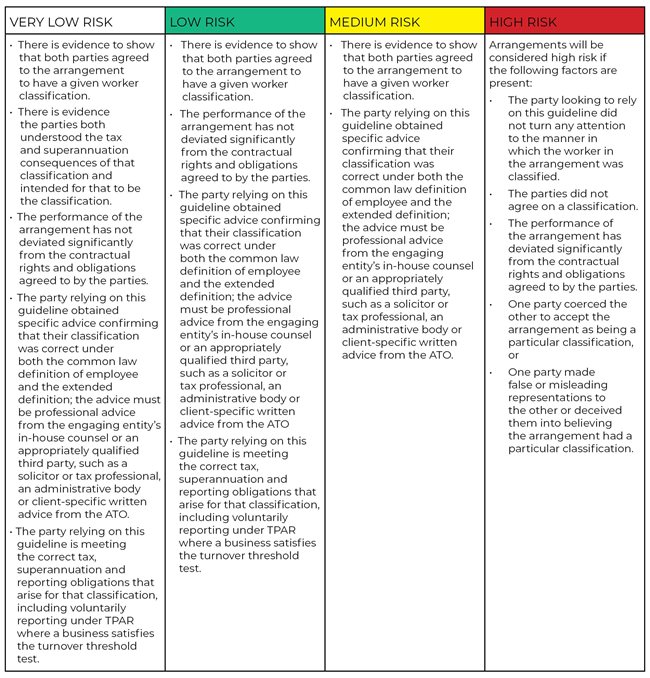

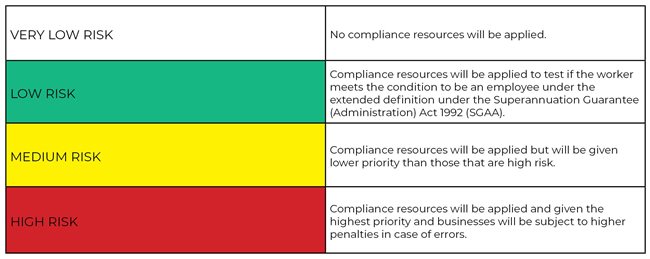

The ATO’s risk assessment framework provides their compliance approach on how they will apply compliance resources in determining whether arrangements have been classified correctly. The following is a summary of the risk framework and the requirements to fall within a particular risk zone:

The following table summarises the ATO’s approach to each risk zone:

OUR THOUGHTS

We have summarised some issues that businesses should consider immediately:

-

The key theme from the various risk zones is that the ATO expects businesses to get specific advice from appropriate professionals to fall into the lower risk zones. An arrangement is high risk if the arrangement does not fall into the white, green, or yellow zones and to fall within any of those zones, there is a requirement to get advice in relation to this issue from the engaging entity's in-house counsel or an appropriately qualified third party, such as a solicitor or tax professional, an administrative body or client-specific written advice from the ATO.

-

The distinction between employees and contractors is dependant on the terms of a contract and is a matter of fact.

-

The ATO will also consider whether the parties are following the terms of the contract or whether they are just sham arrangements.

-

Even if an individual is an independent contractor as per the terms of the contract, businesses will still need to consider whether they may be considered employees under the extended definition per the SGAA. This includes (but is not limited) to situations where individuals are paid principally or wholly for labour.

-

If the ATO determines an individual to be an employee as part of a review/audit:

-

Employers will be liable to pay penalties for failure to withholding PAYG.

-

Employers will be liable to pay superannuation guarantee which can include significant penalties.

-

Employers will not be entitled to any GST credits if they have been claimed on payments made to contractors.

-

Employers will be liable to pay fringe benefits tax on non-cash benefits provided (e.g. motor vehicles).

-

Workers compensation, annual and long service leave entitlement issues may arise as well (although this is not governed by the ATO).

We remind businesses that this issue is mainly relevant in situations where businesses engage with individuals (irrespective of whether they have an ABN or not). Where businesses are contracting individuals through interposed entities (companies or trusts), PAYG withholding and superannuation obligations will not arise. Although, other taxes such as payroll tax may still apply as state legislation has deeming provisions which allow the OSR to look through interposed entities and consider the nature of the relationship between the two parties.

MORE INFORMATION

If you have any queries in relation to any of the above, contact your Moore Australia advisor for more information.