Independent Expert Reports (IERs), or “fair & reasonableness” reports require a valuation of the subject Company. When we write an IER we consider if we can use a listed company’s share price as a valuation method. But there needs to be an “active and deep liquid market” for it to be a meaningful guide to value.

In deciding this we examine share turnover ratios. A share turnover ratio is the volume of a company’s shares traded over a period, as a proportion of the number of total shares on issue. We look at this for a subject Company on both a share trading volume and weighted by value basis.

But what , is usually considered a reasonable level of share volume turnover liquidity in a listed company?

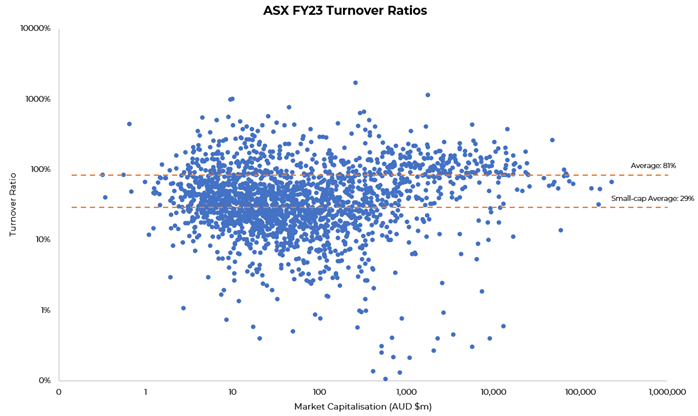

For this example, we calculated the annual share turnover ratio of every ASX-listed stock in FY23. The market cap weighted average turnover of the whole market was 81%. This means that 81% of the total shares on issue was turned over in a single year.

We expected this to be less than 100% given that superannuation funds and other institutional investors tend to hold a significant portion of listed shares for the longer term. For example, FY23 stock turnover by large but popular stocks was:

- BHP 67%

- CBA 53%

- CSL 55%

- WES 55%

- TLS 67%

Companies with very high (> 100% turnover) tend to be funds (e.g. “BetaShares”) and resources companies with (presently) exposure to critical metals or batteries. (e.g. ASX:PMT Patriot Battery Metals). Companies with less than 20% share volume turnover consisted of a mix of resources companies and industrials of varying market capitalisation. They shared no obvious characteristics, other than perhaps being closely held or unattractive. Macquarie Technology Group (ASXMAQ) had just 18.2% turnover with a market cap of $1.6 billion and is an example of a closely held company.

We also calculated the same for small-cap shares with <$100m market capitalisation. The share volume turnover ratio dropped significantly to just 29% for FY23 for these companies.

FY23 Chart – Share turnover % vs Market capitalisation. Note a Log scale is used due to the breadth of data.

Source: S&PCapIQ

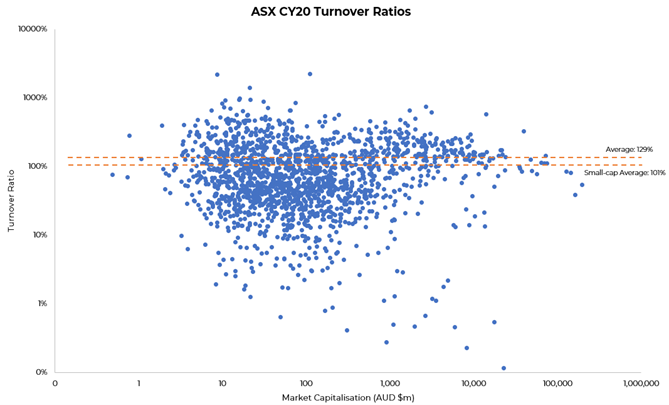

Interestingly, we calculated the same for the 2020 calendar year, which experienced heightened economic (COVID-19) instability. The annual share turnover was much higher, both for all ASX-listed companies at 129%, and for small-cap stocks at 101%. This demonstrates how much large scale market selloffs and rallies can skew the apparent turnover of shares.

CY2020 Chart – Share turnover % vs Market capitalisation (log scale)

Source: S&PCapQ

At Moore Australia, we tend to write IER’s on companies with smaller market capitalisations. I view CY2020 data of 101% as abnormal and FY23 data of 29% as more usual.

Therefore, on balance, I think that share trading turnover volumes below 15% would indicate some concern on the reliability of using the share price as a guide to value.

Of course, there are other factors to consider when determining whether a stock is liquid, including:

- Buy/sell spreads (market depth),

- Ownership and the level of free float,

- Size or pattern of trades in the period. For example if trading activity was isolated to a few big trades or was spread throughout the year.

Whilst a share with a trading turnover volume of below 15% means that we probably can not use the share price as a guide to value, we still should not ignore it outright. It just means that we would likely adopt another valuation approach as our primary approach, (e.g. an income or asset based method). If that approach was significantly different from the implied market capitalisation, it may cause us to consider whether our primary approach is plausible, or if there are other reasons for the difference.

Therefore, our expertise and judgement as the valuer is required for the circumstances. There may not always be a firm answer on where the ‘cut-off’ on share turnover liquidity sits.

Get in touch

If you would like to discuss this further, Moore Australia has valuation experts across the network. Please contact us today to find out more.