From 1 January 2026, Australia’s merger landscape changed significantly, with the introduction of a mandatory merger control regime, requiring pre-completion notification to the Australian Competition and Consumer Commission (ACCC) on acquisitions that meet specified thresholds. This update is particularly important for companies planning to enter the Australian market through acquisitions. This article provides a brief guide around the key issues in navigating this new regulatory framework.

Overview of the new mandatory notification requirements and monetary thresholds triggering ACCC review

It is crucial for acquirers to understand these thresholds, as failing to comply could delay deal completion and lead to potential penalties. Transactions that exceed these thresholds values will automatically trigger an ACCC review to assess their impact on market competition.

Key Changes:

- Obligation to Notify: On the buyer but accessorial liability for knowing involvement. Transaction stayed until notification obtained. Cannot notify during a competitive bid process.

- Notification thresholds: monetary, no competition/market element

- Waiver: Pre-notification available staring 1 January 2026 for transactions which do not raise competition risks or are unlikely to reach monetary thresholds. Not confidential. Can be made during a competitive bid process – unlike notification

- Online portal is active: short form (limited or no competition issues) and long form (clear competition issues)

- Public benefits assessment: Final forms published

Merger Review Thresholds:

- Change of control: Gateway question for transactions involving acquisition of securities – only 20% control may trigger notification

- Connected to Australia: shares or assets to be acquired must be of a business that carries on business in Australia or the asset is used in or forms part of a business carried on in Australia.

- Calculation of thresholds: only Australian revenue amounts to be considered for calculating thresholds

Merger clearance may be required if the transaction involves the buyer obtaining control of the target group and one of the following thresholds is satisfied:

Economy-wide threshold:

- Combined Australian revenue (buyer group +target(s)) ≥ A$200 Million, and;

Any of

- Target group Australian revenue ≥ A$50 million or

- Global transaction value ≥ A$250 million or

- Cumulative Australian revenue of target group and similar acquisitions by the buyer in past 3 years ≥ A$50 million

Very Large acquirer threshold:

- Buyer Group Australian revenue ≥ A$500 Million and;

Any of

- Target group Australian revenue ≥ A$10 million or

- Cumulative Australian revenue of target group and similar acquisitions by the buyer in past 3 years ≥ A$10 million

How the ACCC merger regime interacts with FIRB approval processes and the reduction in regulatory duplication

From 1 January 2026, amendments reduce regulatory duplication between the ACCC and FIRB. The ACCC requires pre-completion notifications for acquisitions exceeding certain thresholds, focusing on competition, while FIRB considers broader national security and national interest factors. The FIRB framework remains separate, but is now tightly integrated with the ACCC’s timeline and information requirements. This coordination means ACCC-cleared transactions satisfy FIRB’s competition requirements, eliminating duplicate analyses. For acquisitions below ACCC thresholds, but with potential competition issues, FIRB may still consult the ACCC, aiding foreign investors in managing timelines and reducing regulatory burdens. FIRB can still reject or impose conditions on a deal even after it has received ACCC clearance.

Timeline implications for transaction planning, including suspensory provisions that prohibit completion pending ACCC clearance

An acquisition that meets the thresholds cannot be lawfully put into effect until the ACCC has made a clearance determination or granted a waiver.

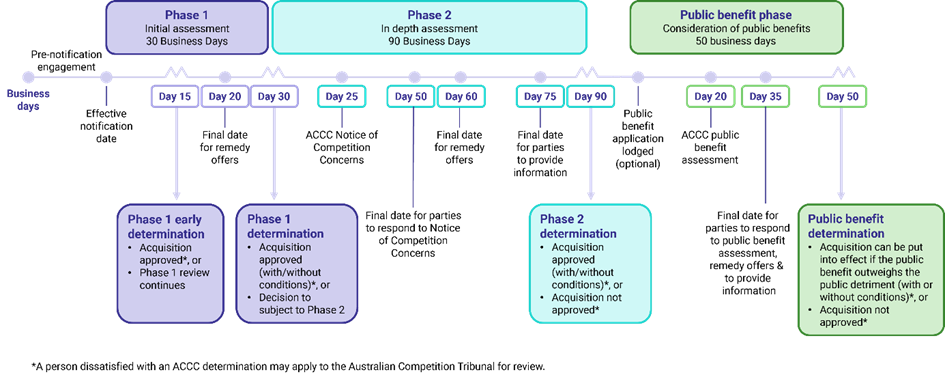

The ACCC’s assessment process includes set statutory timeframes. Phase 1 assessment typically extends to 30 business days, with the earliest approval possible after 15 business days, while more complex transactions may enter phase 2, which can run for up to 90 business days. If ACCC decide to approve the acquisition, they may approve it outright or may approve it with conditions.

These timelines must be integrated into transaction documentation, including conditionality provisions, financing arrangements and deal execution schedules. Multi-national acquirers should anticipate longer pre-completion periods compared to regions without suspensory merger control rules.

Specific considerations for bolt-on acquisitions and roll-up strategies

Under the new regime in 2026, investors pursing bolt-on acquisitions and roll-up strategies should be aware of several key considerations:

- The ACCC will closely examine acquisitions to ensure they do not harm competitive market dynamics, especially concerning market share and competition.

- Even smaller bolt-on acquisitions may trigger ACCC reviews if they meet defined monetary thresholds. It’s essential to calculate aggregate acquisition values carefully to determine if notification is required.

- Successful execution of these strategies requires seamless coordination between ACCC merger reviews and FIRB approvals. Companies must understand the interplay between these entities to effectively manage timelines and regulatory requirements.

Practical compliance steps for acquirers, including preparing competition submissions and coordinating with existing FIRB applications

- Early threshold analysis to determine whether an acquisition is notifiable under the ACCC regime

- Engage early with the ACCC via pre-notification engagement through the acquisitions portal to clarify information requirements

- Coordinate merger notifications with FIRB filings through the updated Foreign Investment Portal to ensure consistency and avoid duplication

- Build ACCC assessment timeframes into deal timetables, recognising suspensory provisions and conditionality

- Prepare clear competition submissions addressing market definitions, competitive effects and any remedies if needed

How Moore can help

If you’re planning an acquisition in Australia, the new merger rules can feel complex. Our Moore Australia advisors are here to guide you. We’ll help you understand your obligations, prepare the right submissions and plan your timelines with clarity.

Get in touch with a Moore Australia specialist to discuss your next steps.