The upcoming Federal Budget is going to be important and hopefully, the Government will carefully consider some issues which in our view require immediate reform. Over the last few months, the Government has spent a considerable amount to sustain our economy and it is now poised to announce a Budget where many are calling for wholesale changes to the Australian taxation system.

We hope that taxation of companies is high up on their agenda - one that needs immediate attention in our view.

What is wrong with the corporate tax rates?

Where do we start? The current corporate tax rate is high in comparison with other OECD countries and our neighboring countries within the Asia Pacific region. A higher corporate tax rate hinders foreign investment and leads to aggressive tax planning and profit shifting.

A lower tax rate has been delivered for certain companies over the last few years by reducing the corporate tax rate for base rate entities (BREs). However, the changes have created a dual tax/franking system for corporates which are complex and could result in wasted tax credits.

BREs are taxed at 26% (dropping to 25% in 2021-22) and all other corporate taxpayers are taxed at 30%. BREs are those that derive more than 80% of their income from defined passive sources. We understand the rationale may have been to provide ‘small’ corporate taxpayers with the tax break but in our view, this had led to some unnecessarily complicated (and at times nonsensical) outcomes. We have seen many small corporate taxpayers being unable to access these lower income tax rates.

To give a background on where we think it went wrong, the following is how the Government(s) went about legislating the changes to corporate tax rates:

-

Between 2001-02 and 2014-15, all companies were taxed at 30%

-

From the 2015-16 income year, companies with a turnover below $2 million that carry on a business (i.e. small businesses) received a lower corporate tax rate of 28.5%.

-

In May 2017, proposed legislation was introduced to lower the tax rate for small businesses to 27.5% for the 2016-17 year and then for all companies to 25% by the 2026-27 income year, irrespective of turnover. These changes did not proceed, but the Bill was only scrapped in August 2018 – more than a year later!

-

During this time, there was significant confusion in determining when companies carry on a busines. The ATO, in response to this, released a draft taxation ruling (TR) 2017/D7 in October 2017 on when it considers a company to be carrying on a business. In summary, nearly all companies carry on a business as per the ATO’s broad views.

-

Around the same time in October 2017, the Government introduced another Bill introducing the concept of BRE as we know it now (removing the requirement for an entity to be a small business). As part of the changes, the turnover threshold was increased to $10 million (rising to $50 million in 2019-20). Tax cuts were also brought forward and delivered exclusively to BREs (dropping over a few years to 25% in the 2021-22 income year). These changes proceeded in August 2018 – nearly a year after legislation was introduced.

-

During the 2015/16 and 2016/17 income years, a company was able to access the lower corporate tax rate if it carried on a business, but could only access the lower rates if it was a BRE from the 2018 income year onwards.

-

Furthermore, by introducing the concept of BREs, the ATO’s ruling on carrying on a business became ‘semi’ pointless and rather than withdrawing the ruling, the ATO ‘repurposed’ the ruling and finalised it as TR 2019/1 with limited scope. Still in place, this now adds to the confusion on whether or not a company carries on a business.

-

Lastly, BREs were not allowed to adjust their franking account for the change in tax rate, meaning many companies who had paid tax at 30% could now only frank dividends at the lower corporate tax rate (currently 26%). When the corporate tax rates were reduced in 2001, taxpayers adjusted their franking account to reflect the change in rates but, inequitably this time around, no adjustments were allowed which led to companies having excess franking credits.

If you are confused reading the above, do not worry because it did not seem like a coherent, well-thought out plan even though it was debated in Parliament for more than a year.

These changes highlight some of the uncertainty small business taxpayers have had to encounter over the last few years and rather than making things simple and fair, it led to increased compliance costs.

Why drop corporate tax rates when the Government needs to balance the books?

Besides the arguments for increased investment and making Australia more attractive to do business in, the reductions in corporate tax rates may ultimately increase taxation at the shareholder level as summarised below.

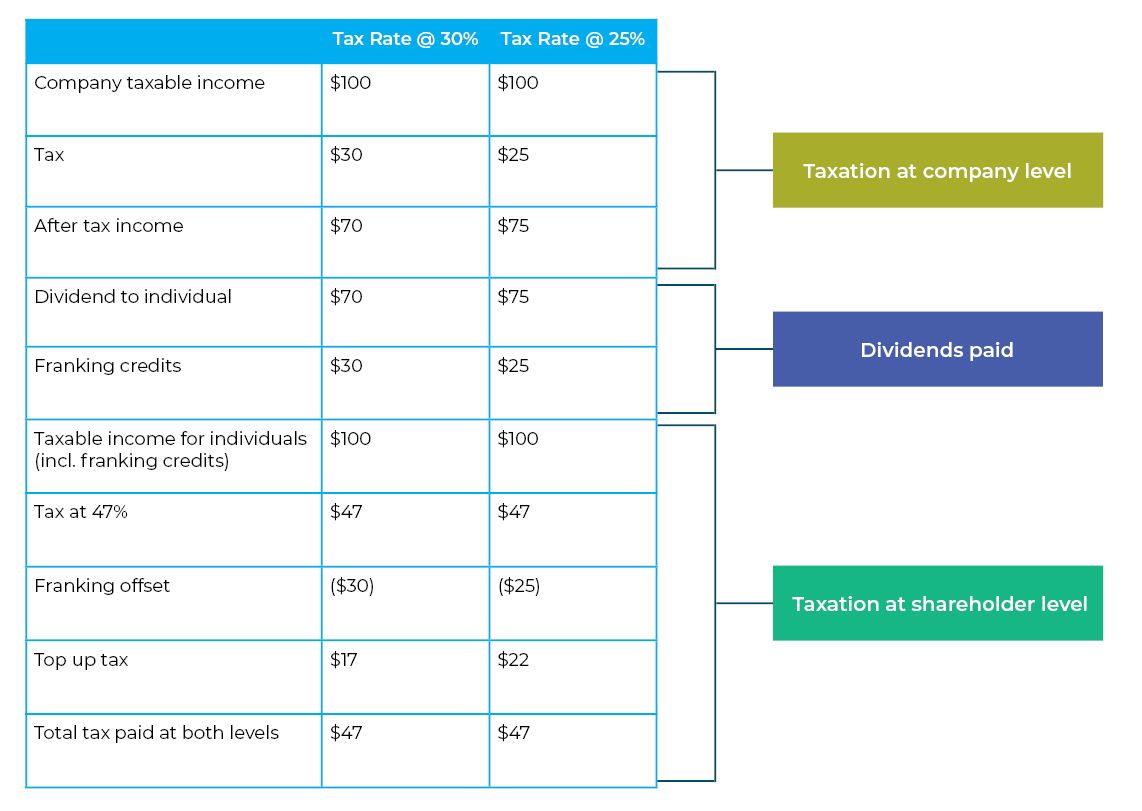

When a company pays a dividend to Australian resident shareholders, the shareholder may be liable to pay ‘top-up’ tax or receive a refund of franking credits depending on their marginal rate of income tax. The following example shows the ’top-up’ tax payable at the highest tax rate if the corporate tax rate (and therefore the franking rate) reduces from 30% to 25%:

Whilst the reduced corporate tax rate will result in a decrease in corporate tax revenue from the Government’s point of view, there is an increase in individual tax revenue when the dividends are taxed at the shareholder level.

In conclusion

By introducing a dual corporate tax system, the Government created a complex system leading to a compliance burden on taxpayers. The removal of BREs from legislation and reducing the corporate tax rate to 25% for all companies in Australia irrespective of turnover, will go a long way in simplifying our tax system.

We have seen some peculiar legislation being introduced over the last few years (e.g. attacking non-residents and their main residences), and hope the Government looks into fixing these issues which have wider impact on our business environment.